The Role of Government Initiatives in Promoting Medical Tourism in India

02 April,2025

Read More

02 April,2025

Read More

Enquire now in case of any assistance needed

12 March,2025

12 March,2025

Imagine the unexpected: a medical crisis arrives, followed by the stark reality of costly medical bills. In a landscape of ever-increasing healthcare expenses, this is a common anxiety. Shockingly, over 60% of healthcare costs in India are paid directly out-of-pocket. But there's a practical solution: health insurance.

It's not just a policy; it's your proactive financial shield against those unpredictable costs.

This guide cuts through the complexities, providing the knowledge you need to make informed decisions. It will discuss the different types of plans, what they cover (and what they don't), how to navigate the claim process, and share expert tips to maximise your benefits.

Let's take control of your health and wealth, securing peace of mind in today’s evolving healthcare landscape. Ready to start?

What is health insurance, exactly? It's a legally binding contract between you (the insured) and an insurance company. You pay a regular premium (like a monthly bill), and in exchange, the insurer agrees to cover a portion or all of your medical expenses if you become sick or injured. It's a crucial tool for preventing financial ruin due to health expenses.

How does it work here? The insurance company reimburses you for covered costs or directly pays the hospital (cashless treatment). Coverage extends to various medical treatments, hospitalisations, surgeries, and sometimes even alternative therapies.

With medical inflation in India reaching an estimated 14% annually, having health insurance is increasingly vital. It acts as a financial guardian, protecting you from the unpredictable nature of health expenses.

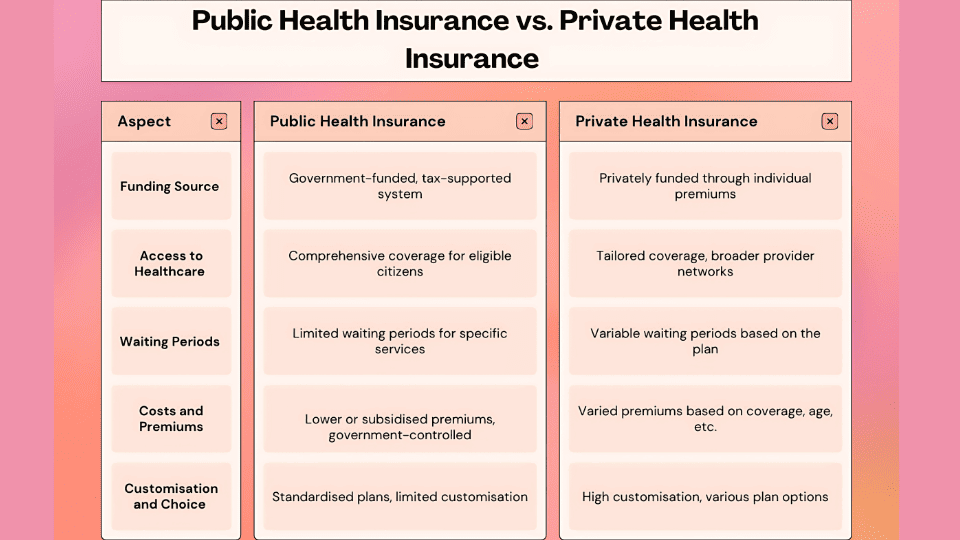

Choosing the right health insurance plan depends on your healthcare needs and financial situation. Here are the most common types of health insurance available in India:

Now, let's dive into what is actually covered under health insurance policies in India. Coverage can vary, but here are some typical inclusions.

Note: Always review your policy document carefully to understand the specific coverage details. No policy is the same.

When selecting a health insurance policy, consider the following factors:

Health insurance claims are settled in two ways: cashless and reimbursement.

Cashless Claim Process:

Reimbursement Claim Process:

Common Claim Rejection Reasons:

Here's how to get the most out of your health insurance:

Health insurance in India is more than a policy; it's your shield in a changing healthcare landscape. Choosing the right plan with careful consideration can reduce financial burdens and offer peace of mind.

Understanding different plans, coverage, and the claims process enables informed decisions that protect your health and finances. Take time to compare policies, assess needs, and choose wisely for a healthier, more secure future.

Start comparing health insurance plans today and take control of your healthcare journey!

Doctor of Pharmacy

Dr. Deepanshu Siwach is a skilled clinical pharmacist with a Doctor of Pharmacy degree.?He has 4+?years of experience and has worked with thousands of patients. He has been associated with some of the top hospitals, such as Artemis Gurgaon.

Senior Consultant

Medical Oncologist

Nanavati-Max Super Speciality Hospital, Mumbai

Book Appointment WhatsApp UsSenior Director

Gynecologist and Obstetrician, IVF Specialist

Max Super Speciality Hospital, Shalimar Bagh, New Delhi

Book Appointment WhatsApp UsSenior Director

Gynecologist and Obstetrician, IVF Specialist

Max Smart Super Speciality Hospital, Saket, New Delhi

Book Appointment WhatsApp UsSenior Director

Gynecologist and Obstetrician

Max Smart Super Speciality Hospital, Saket, New Delhi

Book Appointment WhatsApp UsSenior Director

Gynecologist and Obstetrician

Max Smart Super Speciality Hospital, Saket, New Delhi

Book Appointment WhatsApp UsSenior Director

Gynecologist and Obstetrician

Max Smart Super Speciality Hospital, Saket, New Delhi

Book Appointment WhatsApp UsFill up the form and get assured assitance within 24 hrs!

The Art of Effective Communication

24 January,2025

Read More

24 January,2025

Read More

Trusted by Patients

"I am Asim from Bangladesh and was looking for treatment in India for neuro. I visited many websites to get the complete information regarding the treatment but I was not satisfied as I was getting confused. In the meanwhile, one of my friends suggested I seek help from Medi Journey as he experienced his medical journey very smoothly and was satisfied with it. They have filtered the top 10 doctors as per experience, the success rate of surgery & profile, so it helps us to choose the best treatment in India. "

"For my knee surgery, Medi Journey guided me to BLK Hospital where I received exceptional care. The team's support and the expertise at BLK Hospital exceeded my expectations. Thank you Medi Journey for making my medical journey stress-free. "

"I came from Iraq for my granddaughter's eye surgery in India facilitated by Medi Journey, due to critical cases they advised us to get a second opinion from the different hospitals before going to surgery. Finally, we went to Fortis Escort Hospital, which helped us to get more confidence for diagnosis. Fortis Escort Hospital has the best eye surgeon team with the latest instruments. Thanks to all team members for providing a high-quality treatment in India at an affordable cost. "

"I came for my hair transplant in India, before coming I was so confused about choosing the best clinic and surgeon for me. But thanks to God one of my friends had a hair transplant in India through Medi Journey. He recommended me to go with them. I am completely happy with my experience with them. They were always very fast in their responses to me. the success rate of my hair transplant surgery is 100%."

"Artemis Hospital, suggested by Medi Journey, turned out to be a great choice for my treatment. The personalized assistance and medical care were exceptional. I'm grateful to Medi Journey for guiding me to a hospital that perfectly matched my needs. Highly recommended! "

"I came from Afghanistan for my treatment in India at Jaypee Hospital, Noida. I had a fantastic experience with Medi Journey. Kudos to them for their incredible support during my medical journey. They not only took care of all the logistics but also connected me with a fantastic healthcare team. Efficient, caring, and highly recommended for a hassle-free medical tourism experience."

"I am Adam from Kano, Nigeria, one of my friends from Nigeria was facilitated by Medi Journey, and he recommended us to go with them. I sent my all reports to them and within 48 hours they reverted with 4 options from different hospitals. They helped me to get a Visa letter from the hospital, arrange pick-up from the airport, and book a hotel for me. Their team is very honest and throughout our stay in India they are with us they are caring for us like his family members. BLK Hospital is the best hospital in India with a top surgical oncologist surgeon team, a very advanced OT, and a Radiotherapy department. I wish more success to Medi Journey. "

"Great experience at the Max Hospital for my spine surgery and was successfully done. I thank my neurosurgeon and his entire team. I recommended all of my country's people to Medi Journey for treatment in India, they choose the best hospital, the best doctors, and the best cost for patients."

"I came to India from Dhaka, Bangladesh for my father-in-law's cardiac surgery at Fortis Hospital. I was confused about choosing the best surgeon for him before coming, but their team helped me to choose the best hospital and best cardiac surgeon in India with very good cost and 100% success rate of surgery. I am very happy with the services, really they make my journey so comfortable that make me feel at home. Thanks again and I like people to choose "Medi Journey" as your travel guide. "

"I am Mohammad from Bangladesh came to India for my general health checkup. Medi Journey offers me the complete package including Pick-up from the airport, hotel services, and 24-hour assistance. They guide you to choose the best hospital in India, the best cost of treatment with top-most doctors and give you complete information about hotel booking, and pick-up from the airport before coming to India They have the best team to help. Always choose Medi Journey for your treatment in India."